Prepare Journal Entries to Record the Admission and Withdrawal of a Partner – SPSCC — ACCT&202 working

Journalise the following transactions: i. Tarun introduced capital by cheque Rs.25,000. - Sarthaks eConnect | Largest Online Education Community

Read the following hypothetical Case Study and answer the given questions:Mr. Manoj Manohar Lal Started a new business with a cash of 60,000 by the name Manohar Lal and Sons on the

Pass Journal Entries: Mr. A started business with 50,000$. Bought merchandise for cash 10,000$. Sold goods for cash 15,000$. Purchased goods from. - ppt download

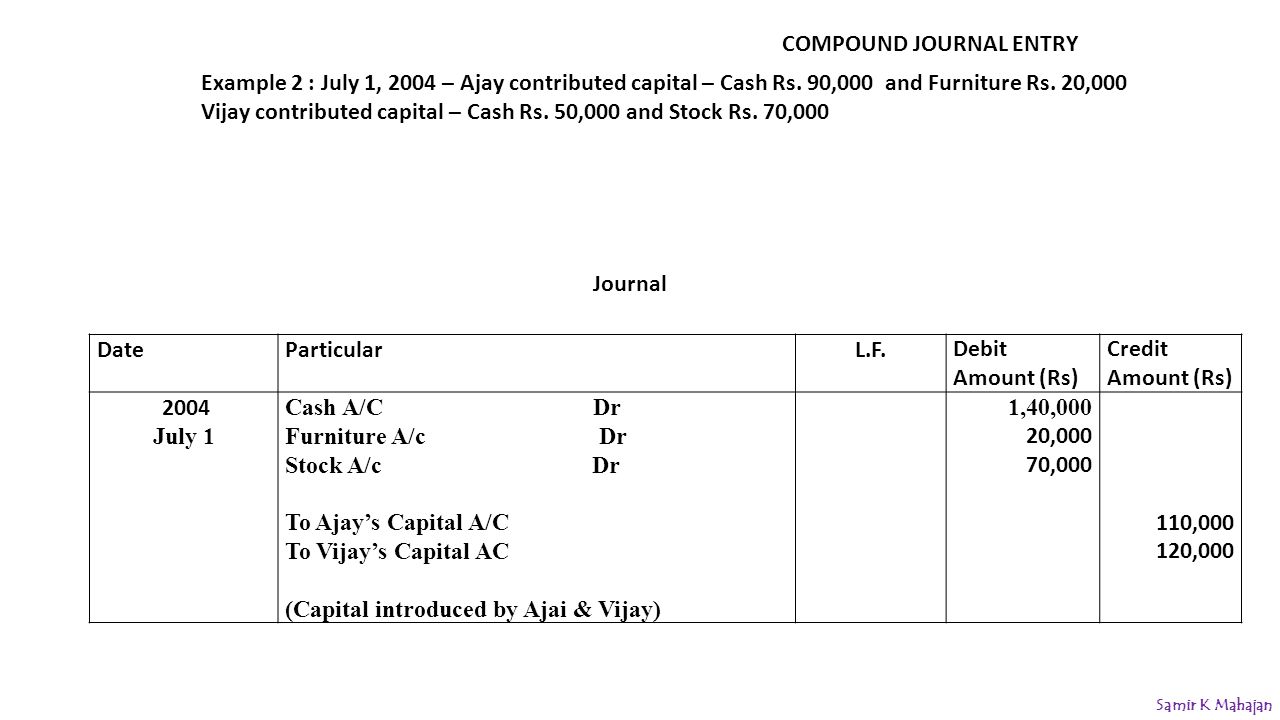

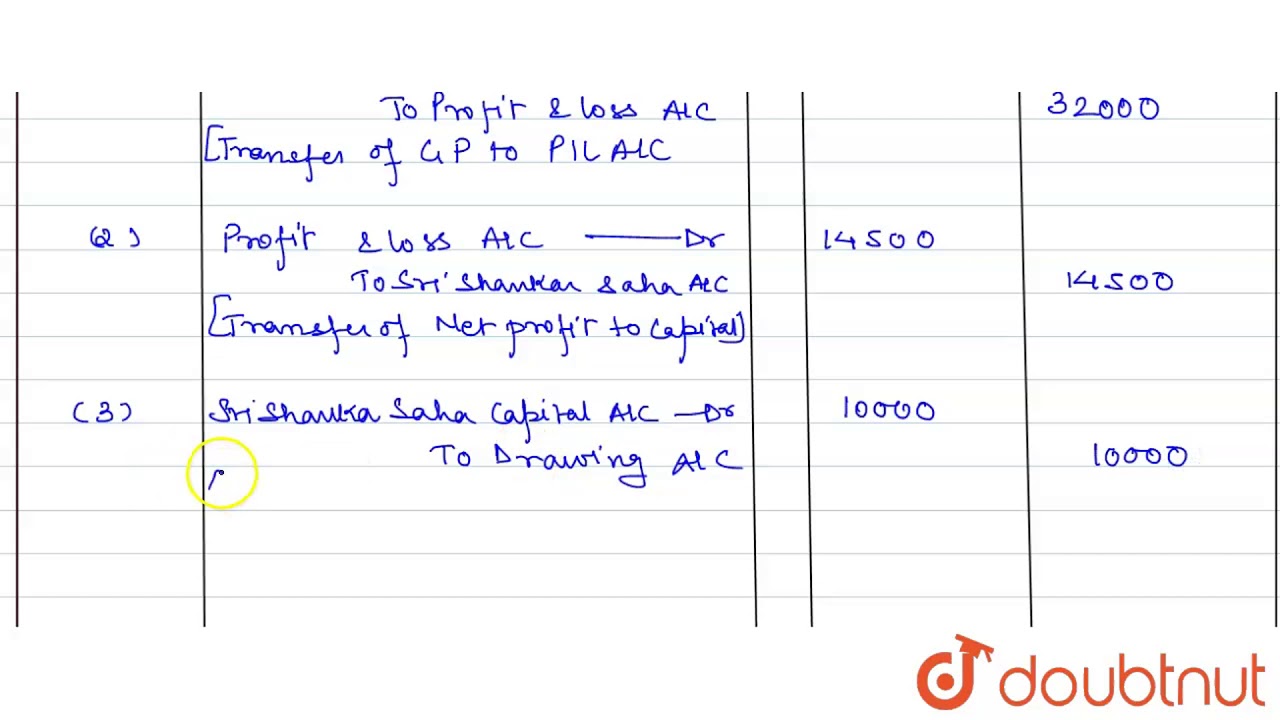

Transfer Entries). Give the Journal entries for the following: (i) Gross Profit of Rs. 32,000 from - YouTube