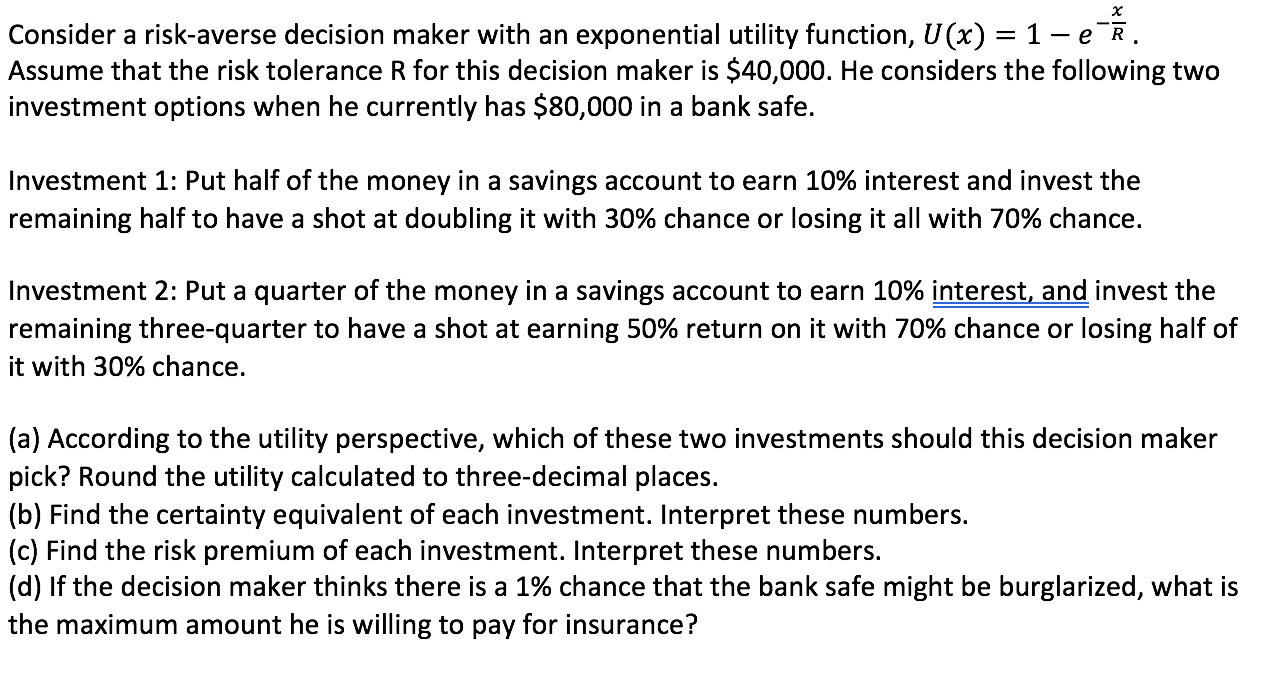

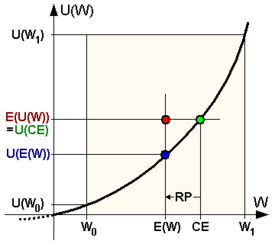

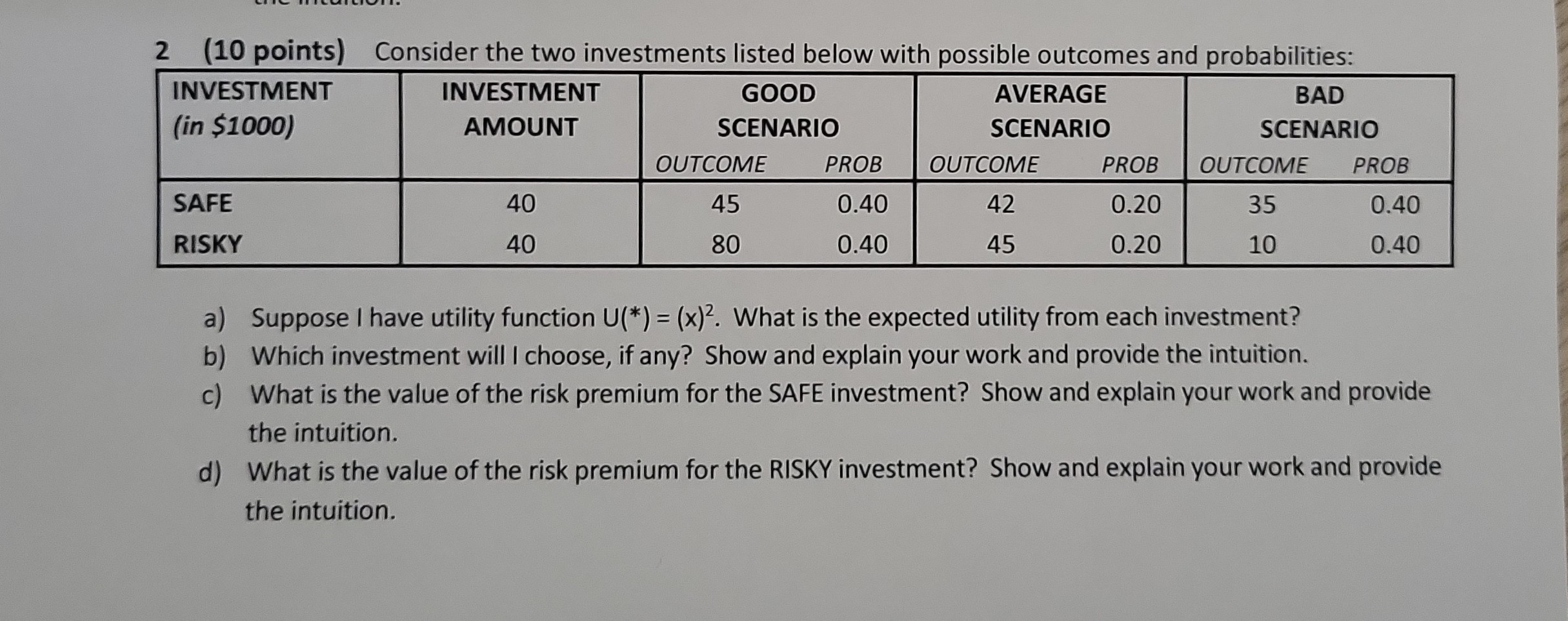

SOLVED: 2 (10 points) Consider the two investments listed below with possible outcomes and probabilities: a) Suppose I have utility function U(^*)=(x)^2. What is the expected utility from each investment? b) Which

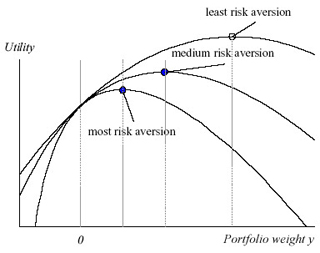

Utility function of utilitarian end expressive benefit of corporate... | Download Scientific Diagram

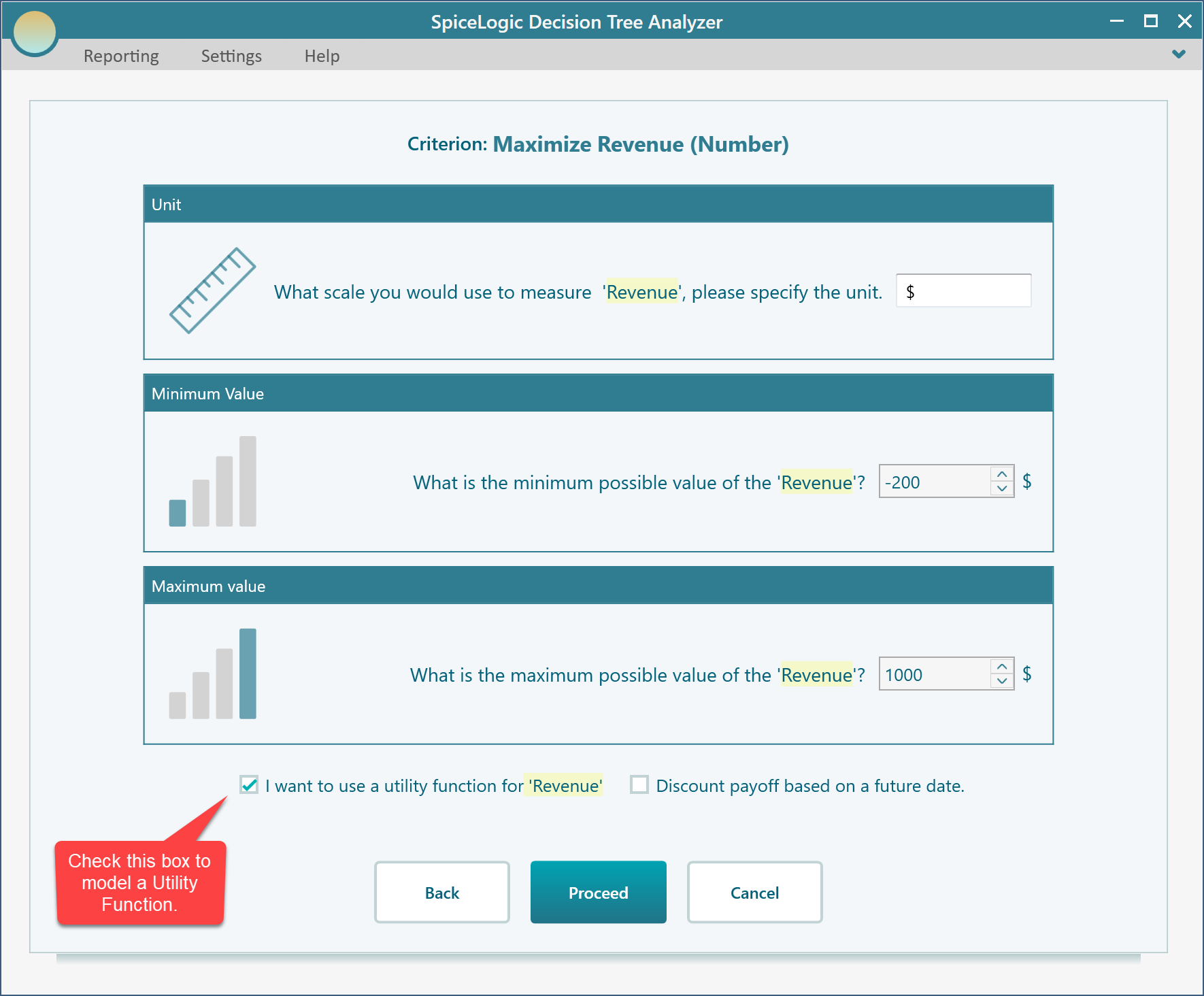

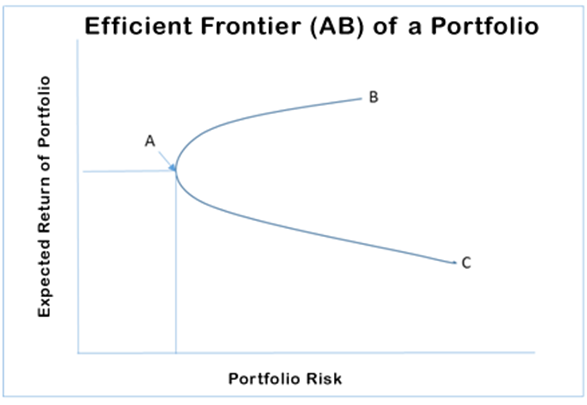

The CEV Model and Its Application in a Study of Optimal Investment Strategy – topic of research paper in Mathematics. Download scholarly article PDF and read for free on CyberLeninka open science

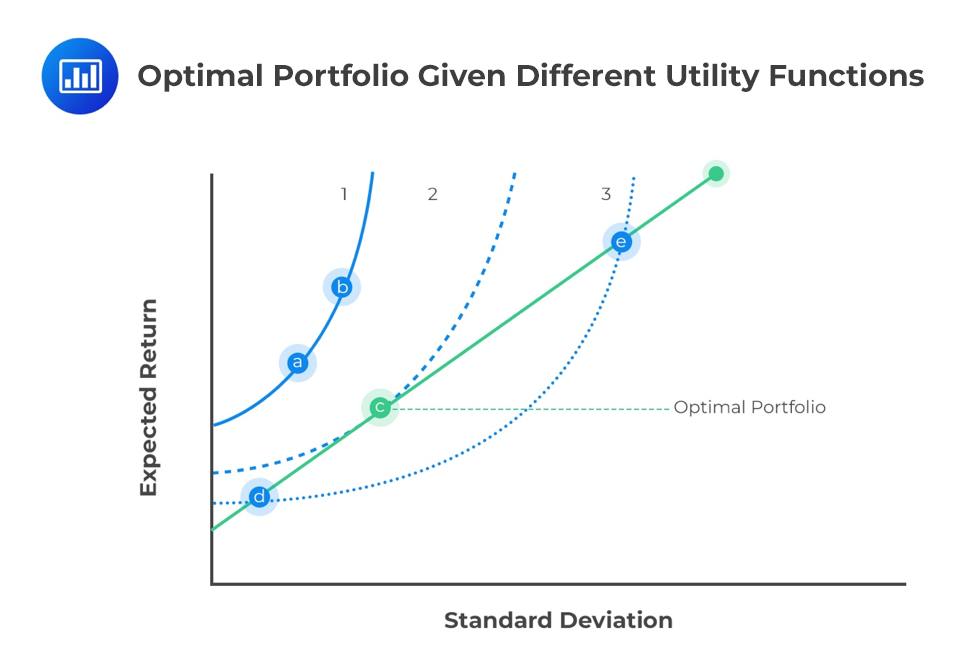

:max_bytes(150000):strip_icc()/TermDefinitions_Utility-e42a7528caa347f9b1af149065ab2b9d.jpg)